The Money Playbook Every Canadian Needs

Discover practical, step-by-step strategies to take control of your money, build lasting wealth, and feel confident about your financial future — written specifically for life in Canada. This is a self-published educational resource, not a commercial advisory service.

The Real Rules of Financial Freedom

This book was created as part of the Money Mindset Canada initiative to support financial literacy in Canada. It is intended for general information and education only and does not provide personalized financial advice.

- Simple budgeting that actually fits real Canadian life

- Debt: when it’s a tool vs. a trap — with clear next steps

- Investing basics, TFSA vs RRSP (explained in plain language)

- Mortgages, insurance, and retirement planning made clear

A Peek Inside

Chapters are written in plain language to help Canadians understand the core building blocks of a healthy money plan. The content is educational and does not recommend specific products or individual strategies.

- Mindset & Goals That Stick

- Budgeting that Fits Your Life

- Credit & Debt — Fixing the Foundation

- Saving vs Investing (and when to do each)

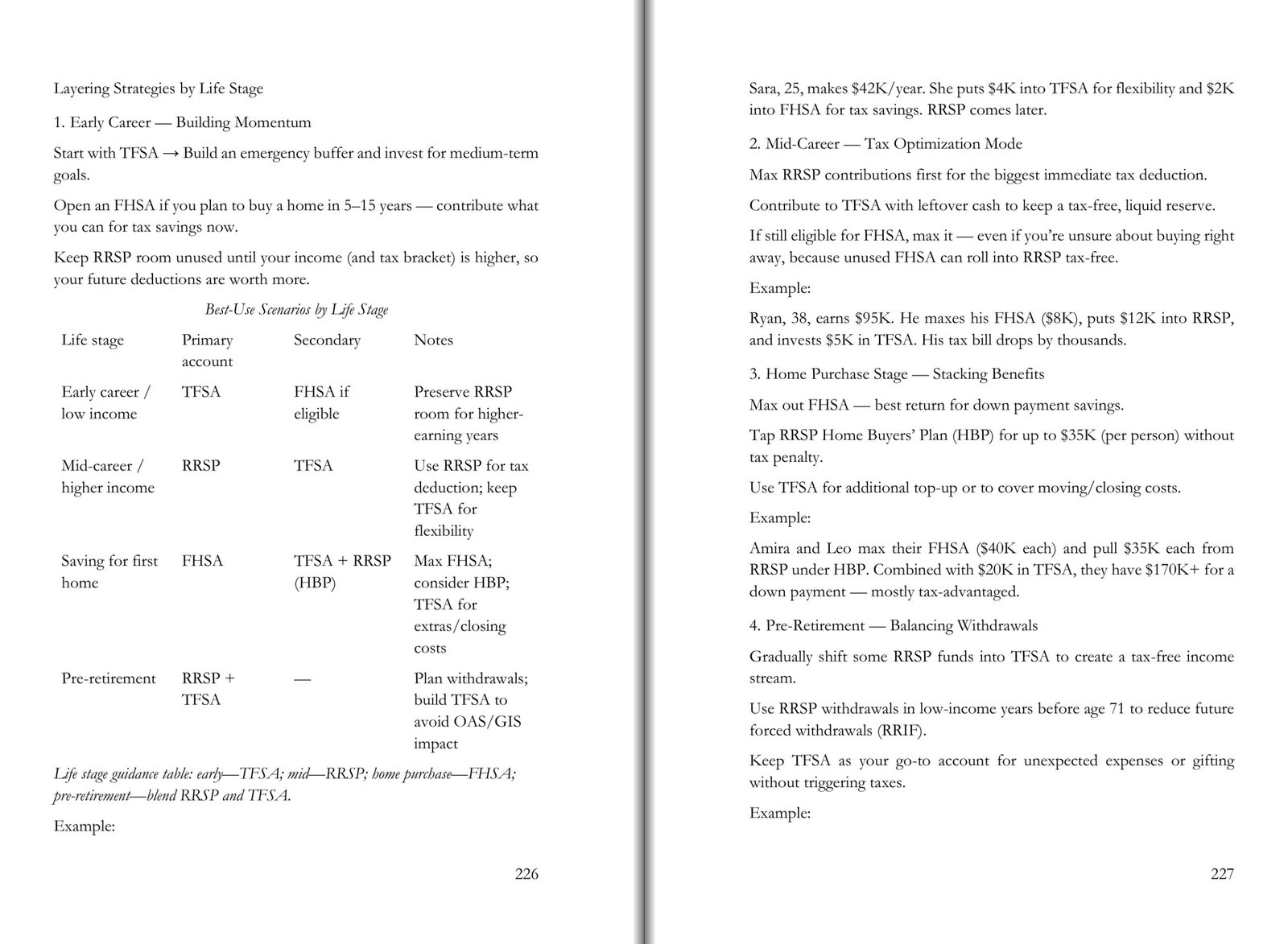

- TFSA, RRSP & Tax-Smart Growth

- Big Purchases & Mortgages

- Protecting Your Progress (insurance & risk)

- Retirement & Freedom Numbers

A Peek Inside the Book

Flip through a few sample pages. Layouts, checklists, and simple explanations are designed to support better decisions, not to replace personal advice from a licensed professional.

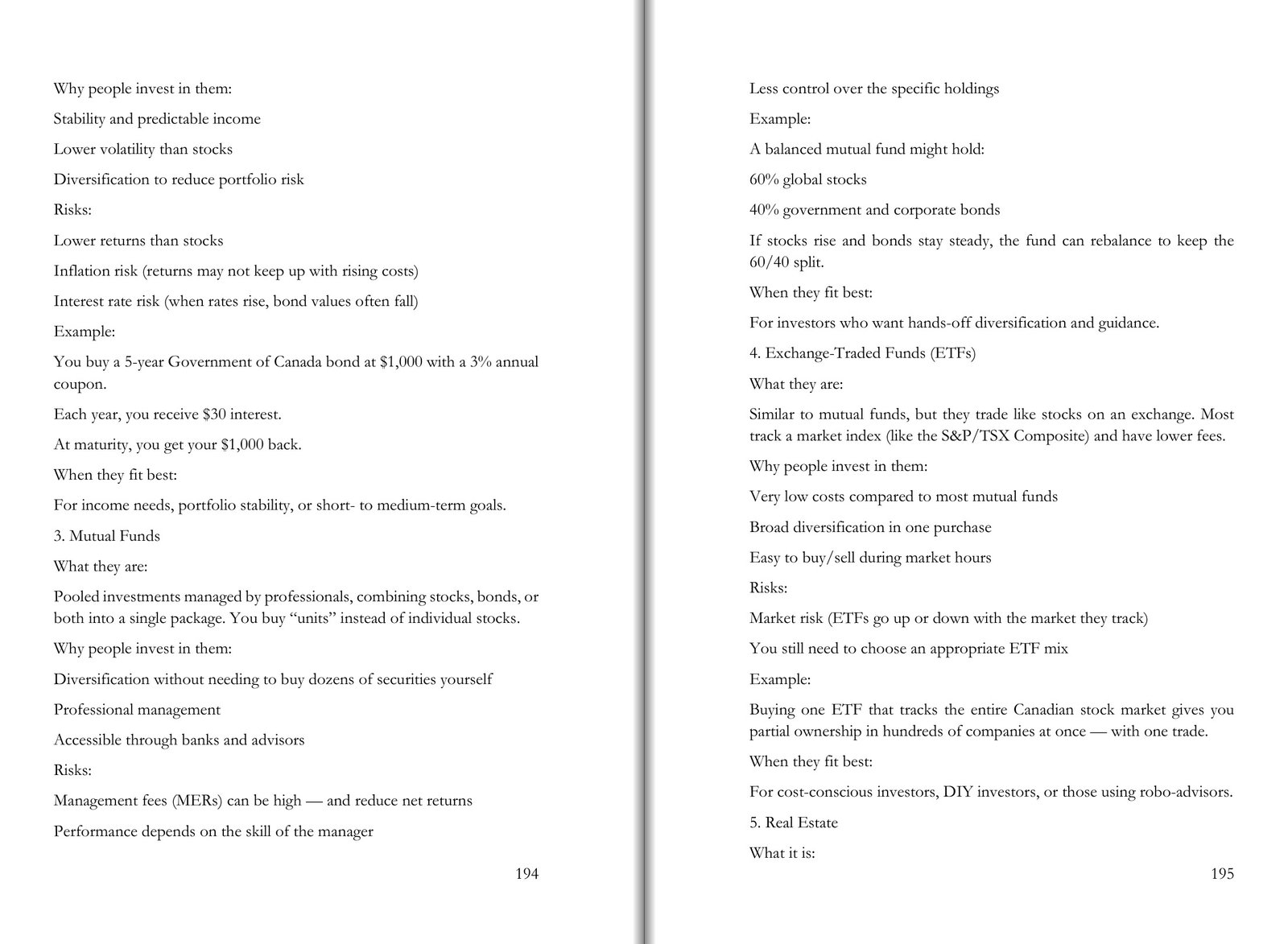

Investing Basics (Plain English)

A simple approach to understanding diversified investing with broad-market ETFs and a risk level that fits your timeline.

- Diversify across stocks/bonds with a 2–3 fund core

- Keep fees low; automate monthly contributions

- Match risk to goals and time horizon

Use these ideas as a starting point and then review your own plan with a licensed advisor or your financial institution.

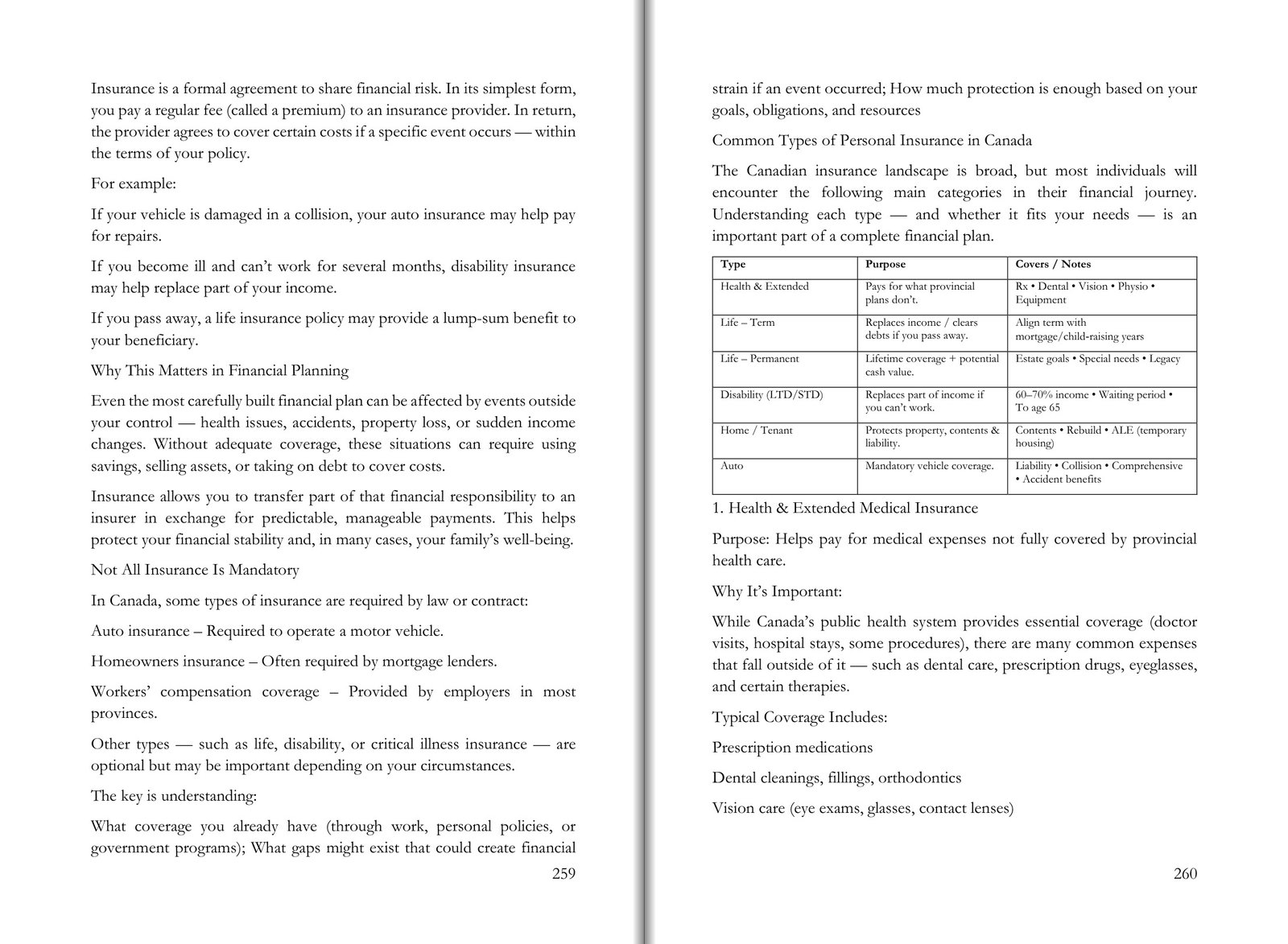

Protecting Your Progress

The essentials: what to insure (income, dependants, big liabilities) and how to think about cost-effective coverage.

- High coverage, low cost

- Match term to mortgage/childhood years

- Review coverage regularly as life changes

- Focus on protecting income first

- Check employer benefits & waiting periods

- Use this chapter as a framework for questions to ask

Smart Borrowing, Real Math

An overview to help you understand how payments, amortization, and rate changes work so you can have better conversations with your lender.

- Know your TDS/GDS and rate-reset risk

- Consider prepayment options and how they fit your plan

- Compare HELOCs and amortizing loans in the context of your goals

Use this as a starting framework, then confirm details and decisions with your bank or mortgage professional.

“Mush's coaching helped me feel more confident about money and make smarter saving decisions. I was finally able to work toward buying my first home.”

— Aida T., Toronto“Mush explains finances in a way that actually makes sense. I finally feel in control of my budget.”

— Samvel K., Montreal“As a newcomer to Canada, I felt overwhelmed. Mush's programs made me feel confident and empowered.”

— Narine G., Calgary