How to Use a TFSA the Right Way

Everything Canadians need to know about maximizing their Tax-Free Savings Account

What Is a TFSA?

The Tax-Free Savings Account (TFSA) is a registered account in Canada that lets you grow your money tax-free. Contributions are not tax-deductible, but any gains (interest, dividends, or capital gains) are not taxed when withdrawn.

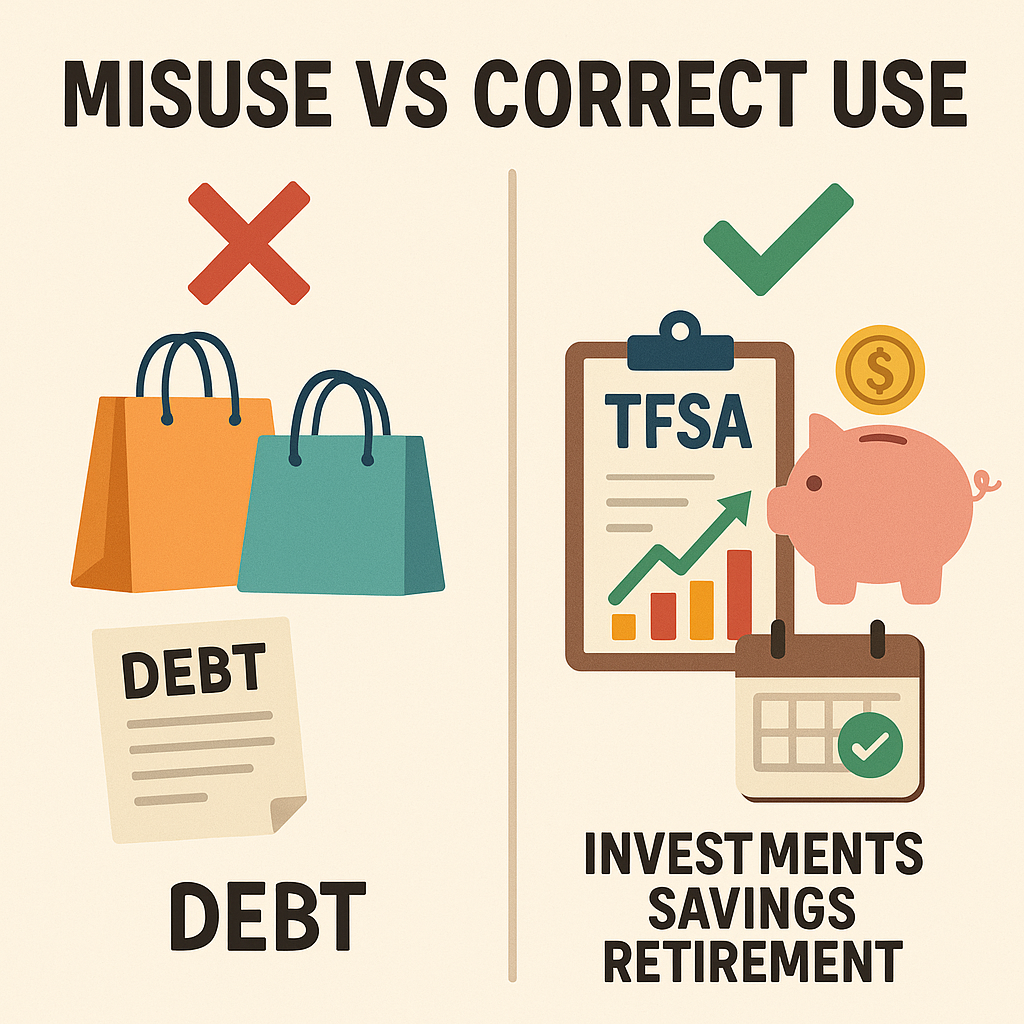

Common Misunderstandings

- TFSA is not just for saving – you can invest too!

- Over-contributing leads to CRA penalties

- Withdrawals do not reduce your current contribution room — they’re added back next year

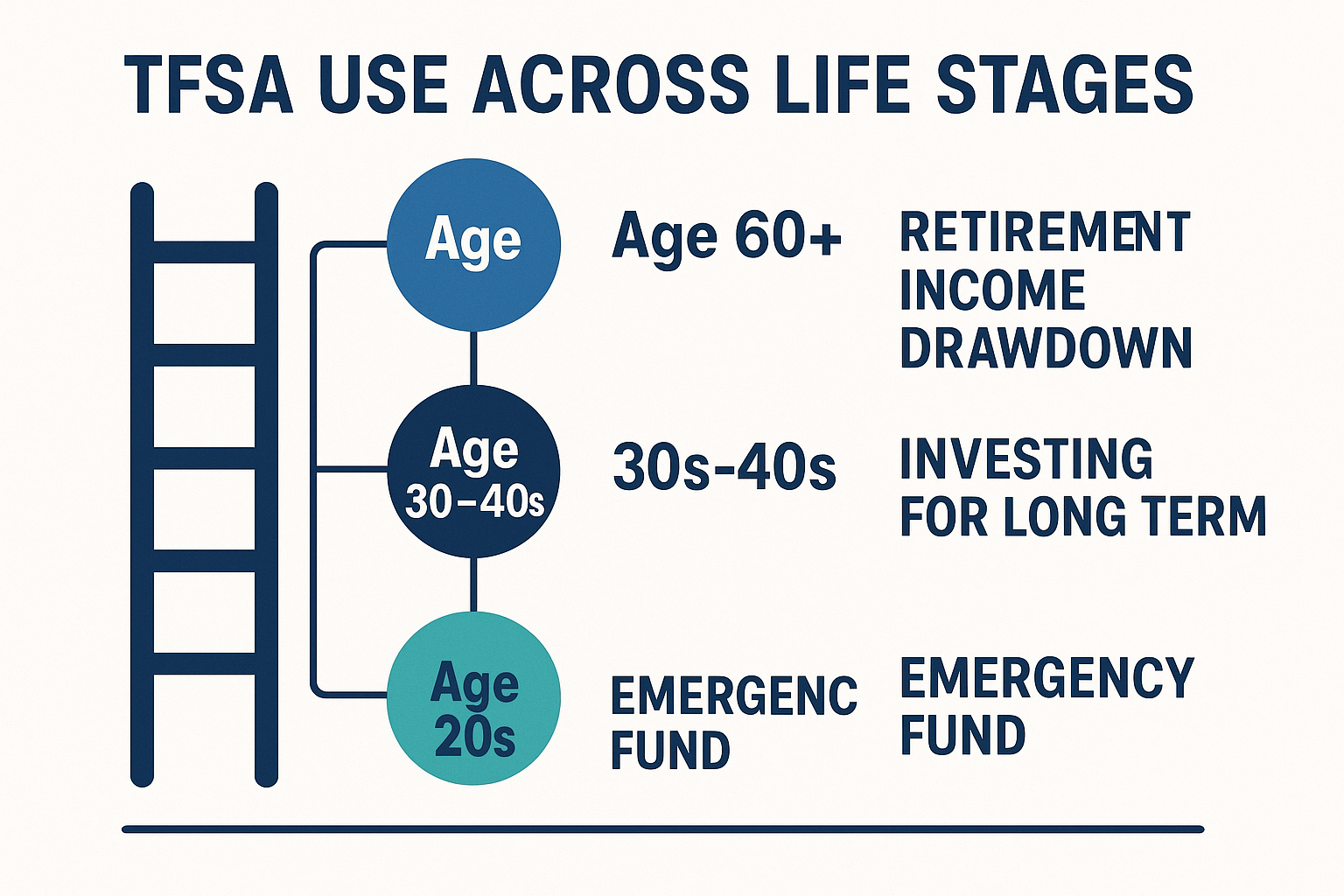

When Should You Use a TFSA?

You can use a TFSA for:

- Emergency savings

- Saving for a home or vacation

- Investing for retirement or long-term growth

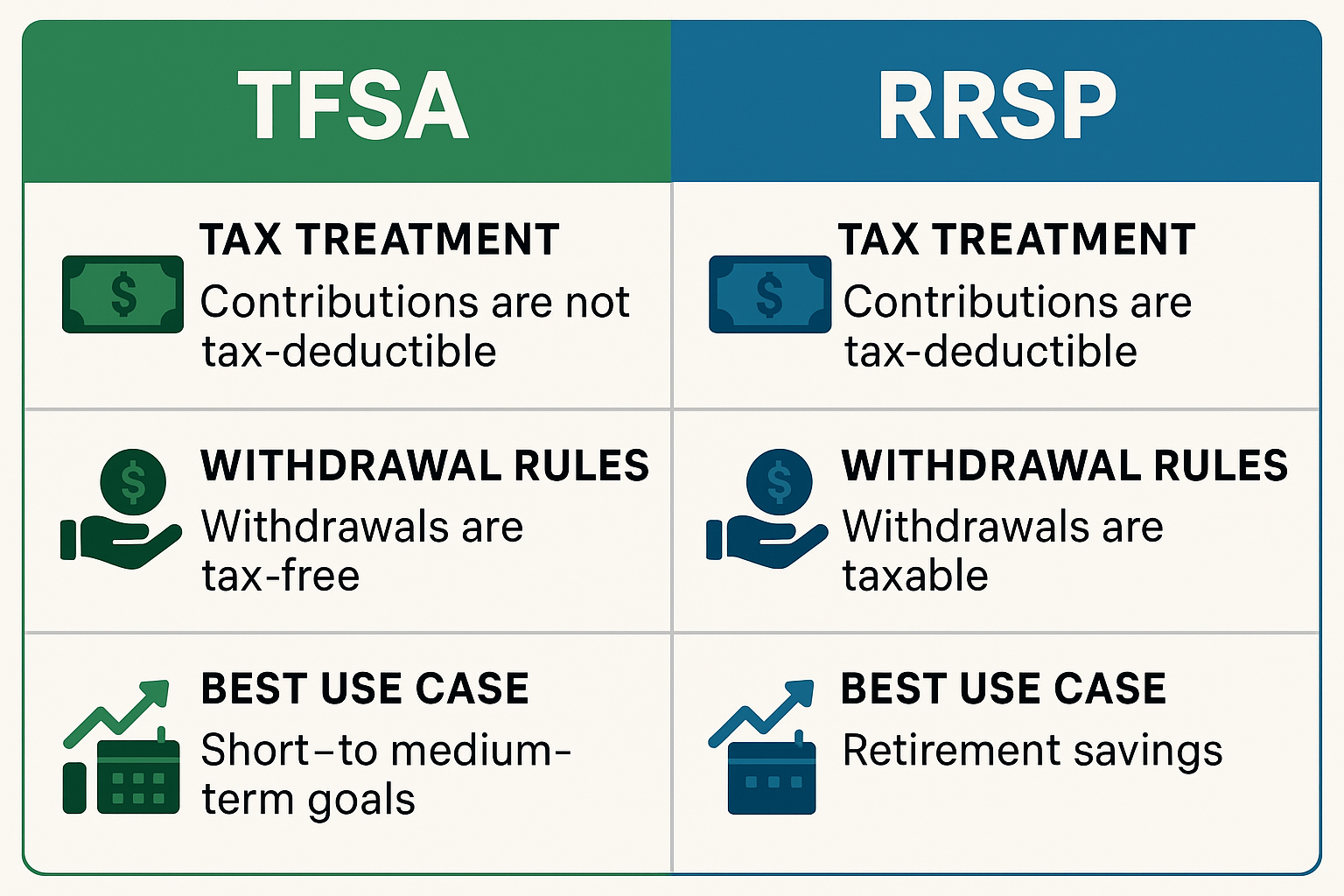

TFSA vs RRSP

TFSA and RRSP serve different purposes:

- TFSA: Best for flexible savings and low-income earners

- RRSP: Ideal for retirement and high-income earners

More on saving vs investing.

How to Maximize Your TFSA

- Use it to hold investments like GICs, ETFs, and stocks

- Reinvest your earnings tax-free

- Make use of full annual contribution room

Final Word

Used correctly, the TFSA is one of the most powerful tools for Canadians to grow wealth. Understand the rules, avoid common mistakes, and use it strategically for short- or long-term goals. Learn more at the Government of Canada: Managing Finances.