Understanding Credit Scores in Canada

A simple guide for newcomers and anyone looking to build strong credit

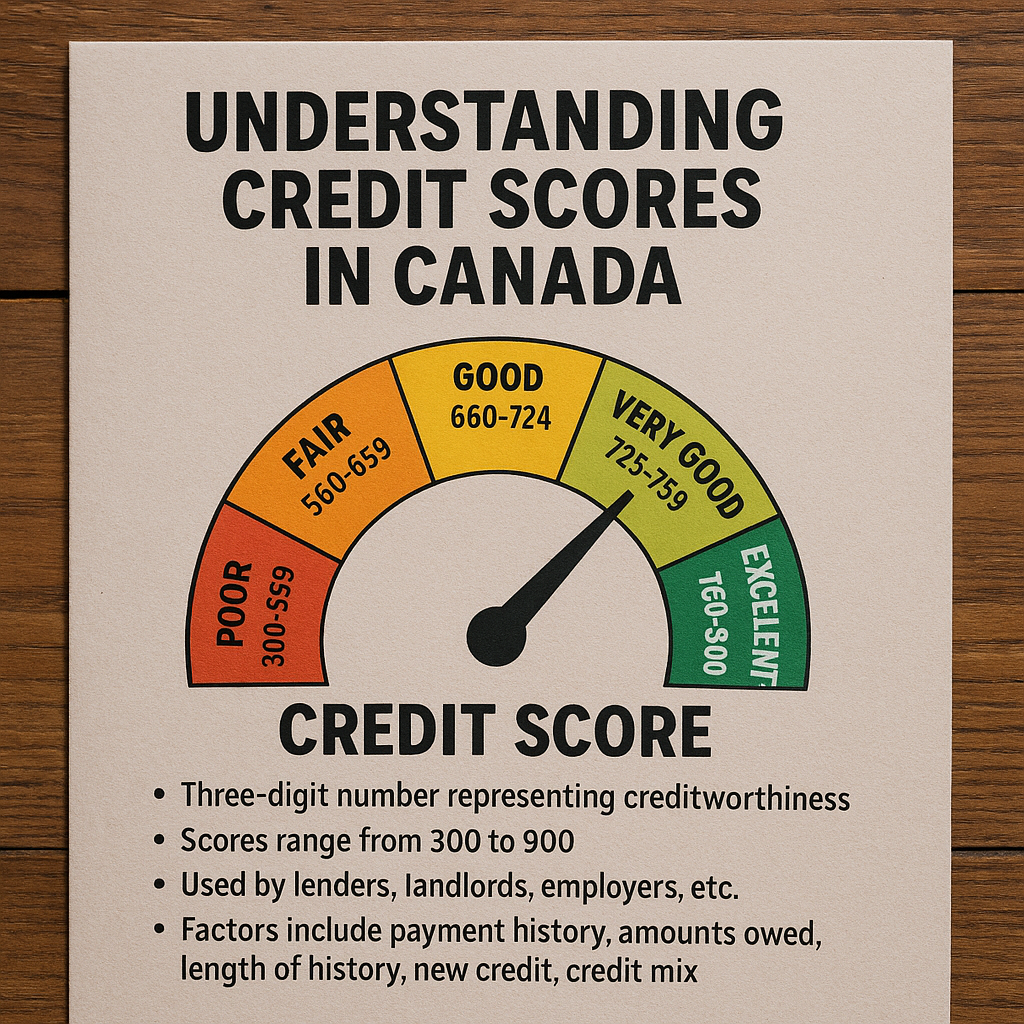

What Is a Credit Score?

Your credit score is a three-digit number (usually between 300 and 900) that tells lenders how likely you are to repay money you borrow. In Canada, the higher your score, the better. Learn more from the Government of Canada’s credit score guide.

What Is a Good Credit Score?

- 800–900: Excellent

- 740–799: Very Good

- 670–739: Good

- 580–669: Fair

- 300–579: Poor

Why Does Your Credit Score Matter?

In Canada, your credit score affects your ability to:

- Get approved for credit cards or loans

- Rent an apartment

- Qualify for a mortgage

- Get better interest rates

Who Tracks Your Credit?

Canada has two main credit bureaus:

You can request your free Equifax credit report or TransUnion consumer disclosure once a year.

What Affects Your Credit Score?

- Payment history (35%): Always pay on time

- Credit utilization (30%): Keep balances low

- Credit history length (15%): Longer is better

- New credit (10%): Too many recent applications may hurt

- Credit mix (10%): Variety of accounts (e.g., credit card + auto loan)

How to Build or Improve Your Credit

- Always pay your bills on time

- Use less than 30% of your credit limit

- Don’t apply for too many credit cards at once

- Keep your oldest credit account open

- Check your credit report for errors

Important Note for Newcomers

If you’re new to Canada, your credit history from another country doesn’t transfer here. You’ll need to start fresh — but don’t worry! With good habits, you can build strong Canadian credit within 12–24 months.

Final Thoughts

Your credit score is a key part of your financial journey in Canada. By understanding how it works and how to build it wisely, you’re setting yourself up for success — whether you’re renting, borrowing, or just starting to save.